Payday Loans Are Coming For Everyone

A number of media companies are offering freelancers the option to pay to get their own money

UPDATE: After this piece was published the Huffington Post has told me they’ve disabled the FastFunds payment option on their end.

UPDATE 2: ADP, the human resources conglomerate that owns WorkMarket tells me they have “decided to temporarily suspend WorkMarket’s FastFunds offer until we can review the practice more carefully.”

UPDATE 3: The New York Times responded to my requests after this piece was published saying they had not contracted with WorkMarket and that a video of their CTO discussing doing so was posted preemptively and has been taken down.

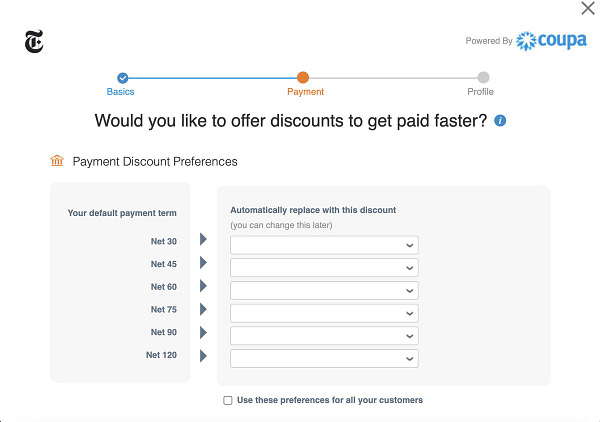

UPDATE 4: (2022 version): Looks like it’s back on at the NYT baby!! What a deal.

On July 15 this year I published a story on the Huffington Post about a media company taking advantage of its workforce. Northside Media, the company that owns Brooklyn Magazine and a number of other properties had been exceptionally late in paying or had failed to pay many of their workers for years. Ironically, the piece was meant to run in The Outline the week before, but it had been killed at the last minute for reasons that remain unclear to me. For the days of work and dozens of interviews I conducted, I would have been paid around $1200 by the Outline. In my scramble to get it placed anywhere I agreed to accept $700 from the Huffington Post. I felt lucky to have recouped any sort of compensation for my work at that point.

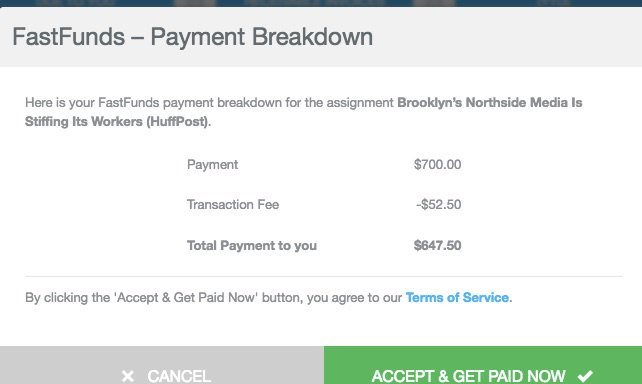

The story came out well nonetheless, and as a result many of the freelancers told me they had subsequently received checks from the publisher hoping to make good. But something curious happened when it was time for me to get paid myself. After setting up an account on WorkMarket, the payment portal the Huffington Post uses — freelancing in 2018 means navigating dozens of such byzantine portals and handing over all of your sensitive banking information to systems of dubious security — I was notified a month later that my payment was finally ready to go through. There was just one catch: If I wanted any money right away I would have to pay them $52.50 for the privilege of getting paid.

WorkMarket, the third party service that the Huffington Post and all of the Oath properties — Yahoo!, AOL, TechCrunch and others — uses to manage its accounts payable, was providing me the option to get paid earlier than I would normally, through something called FastFunds. That would be after forfeiting an ~8% cut, or around 195% APR to be clear. While that’s not quite the typical 400% a payday lender might charge — where the cost of borrowing $100 is between $15-30 if you manage to pay it back on time — it’s not that far off. If I preferred to wait another few weeks on top of the month plus I was currently waiting I could receive the full $700.

While WorkMarket insists that this is not the same thing as a payday loan, it’s not exactly clear how it differs in spirit. True, there are no penalties or debts assumed by the worker for late payments, but on the other hand the penalty is just moved to the front of the transaction.

WorkMarket was acquired by ADP, the financial services giant with $12.4 billion in revenue in 2017, earlier this year.

I asked my editor for the Huffington Post piece what the fuck was going on, and he told me he’d never heard of it.

“Now for the first time, thanks to Fast Funds Mobile,” as WorkMarket VP Mousa Ackall wrote in January of 2017 when announcing the service, “freelancers can gain instant access to their funds via the WorkMarket mobile app – offering the level of flexibility and effortless mobility that modern workers crave.”

Ah, finally, the level of flexibility and effortless mobility I deserve.

I did not happen to be in dire need of the money right away that particular month, but as a freelancer, there have certainly been times in my life that I might have been tempted to take the devil’s deal. There are no shortage of people in more tenuous financial situations that might not be able to turn it down. In fact, as Jens Audenaert, general manager of WorkMarket explained to me, it’s proven to be an exceptionally popular feature and its use continues to grow. Weird!

Michael Sainato is one of them. He’d written a piece for the Huffington Post about Standing Rock activists in July. After a month of waiting to be paid, he was told to sign up for WorkMarket as well. A couple of weeks later, he got a notification that the $400 he was owed was available to him, but the only clickable option to withdraw the money was on something called FastFunds, something he’d never heard of. Confused and clicking around on the site he said he somehow selected the payment option, and $30 was subtracted from his invoice. He told me that while it was a mistake, he would have taken the cut regardless, because the payment was already exceptionally late and he was hard up for cash that month.

“It’s absolutely predatory,” Sainato told me. “You shouldn't have to be charged to get paid in a reasonable amount of time and HuffPost is well aware that freelancers tend to have financial issues in that they can't push off being paid several more weeks, few people can.”

“No one would reasonably spend $30 or more on [getting paid] unless they were financially put in a position where they couldn't afford not to.”

While the idea of early payment discounts aren’t novel in large industries like construction or manufacturing, where suppliers might arrange to let a company pay less than full price of an invoice if they do so in a prompt fashion, and factoring is a longstanding tradition, in which businesses sell their accounts receivable to a third party in order to facilitate having cash flow on hand more quickly, the concept coming to individual creative industry workers is novel, and yet another example of how media professionals, and freelancers in particular, are being preyed upon.

The early payment model WorkMarket is using is part of a movement across the economy at large to let workers, often hourly workers, access the money they’ve already earned earlier than usual. Walmart announced last year that its workers would be able to withdraw from their paycheck early up to eight times a year for free through a service provided by PayActiv, one of a fast-growing number of instant-pay apps that look to be the future of hourly employment. PayActiv likens the fees they charge employees accessing their own money ahead of payment schedule as akin to an ATM service charge.

A convenience fee if you will. The convenience of getting your fucking money.

Many on-demand work companies similarly offer instant payment options. Uber, for example, charges a $0.50 transfer fee for every cash out, stipulating that it must be for a minimum of $1 in earnings, which is a particularly grim fucking proviso if you think about it.

Yahoo! is one company who’s delighted with their experience with WorkMarket. In a glowing case study on the site, they say that within 45 days they had “successfully onboarded hundreds of freelance contributors.”

Elsewhere on their site they boast of their partnership with John Battelle,

Founder of WIRED Magazine, on his new venture NewCo Shift, and the New York Times.

“The New York Times chose WorkMarket to streamline the management and payment of its editorial freelance workforce,” they write. A video posted to the site, that has since been taken down, shows an interview last year with Nick Rockwell, CTO of the New York Times, explaining how WorkMarket has helped them handle their labor needs. They have about 5,000 active freelancers at anytime, and 20-30,000 per year. “A mountain of people,” he says.

“We’re very excited to be working with you guys and getting to a better place,” he says.

After this story was published the New York Times responded and told me they had not yet decided to implement WorkMarket’s services and that they asked them to remove reference to the paper from their website and to take down the video above.

“The video was “done in anticipation of working with them, though clearly not appropriate for it to be used by them until and if we end up utilizing their service.”

Multiple requests for clarification I sent to Oath on if they use WorkMarket and FastFunds in particular were ignored. An email I sent to the Huffington Post media contact for comment on the FastFunds option was also ignored. A media representative from the New York Times replied to my request wanting to know a bit more about who I am and why I am seeking this information, and then ignored multiple follow up emails.

Well, I’m a freelancer, motherfucker, and I’m curious just how normalized this type of predatory payday-loan like behavior is going to become for myself and my colleagues going forward. Either you use this system or you don’t that seems like a pretty simple question to answer. Exactly how much shit will we all be forced to eat in this exciting new streamlined future?

After weeks of trying, I finally managed to get someone from WorkMarket on the phone to justify this “feature” to me. I am, after all, one of their users now, albeit against my own wishes. I asked WorkMarket general manager Jens Audenaert to explain to me why this is not a payday loan.

I’ll make $0 off of all of this by the way.

How many companies do you provide payment services for?

Specifically FastFunds? That’s really a voluntary feature for freelancers to get access to payment early. It’s separate from the contract with the paying clients we have. WorkMarket has in the hundreds of clients. We don’t disclose who they are without their permission. By and large this is a feature that’s available to the vast majority of the freelancers working for those clients. If clients want to opt out they can, but that has not happened that often.

What is the thinking behind FastFunds? Who does it benefit?

I think the real important thing to understand here is that we’re talking about freelancers and not employees, this doesn’t relate to getting access to a paycheck early. Freelancers are on an accounts payable cycle, that can be 30, 60 to 90 days after the work is complete. This is a convenient option for freelancers. It’s voluntary, they can wait at no cost to get payment on the terms set by client. This is an offer to get paid early, pretty much to get paid as soon as payment is approved.

The thinking behind it initially and which still resonates in the market today is that managing your accounts receivables, your invoice, your income for freelancers, is one of the biggest pain points they have, especially for freelancers that work for a number of clients. When we ask freelancers late payment was the number one issues in terms of managing their financial wellness. This is really making sure that as they are confronted with a payment cycle that can span into months they don’t have any issues with cash flow or tracking those invoices over time.

Have many people elected to take the early payment option?

It has a very healthy pick up rate among our freelancers. It is something that we’ve only seen increase pick up of it over time.

How does it work? You buy the accounts payable from a company like the Huffington Post?

The way it works is we pretty much take the headache away from the freelancers. Should they not get paid by the client we don’t go after that money. Again it’s not a loan, there’s no repayment. We take the credit risk away from freelancers. The other thing to highlight with freelancers is that the WorkMarket platform allows them to set their own rates. A lot of workers who take advantage of this feature might consider this a cost of doing business and reflect it in their rate. If you look at other freelancer platforms many of them have ways they actually charge the worker, and the freelancer can set their rates appropriately.

You said you won’t go after money if the publication doesn’t end up paying?

If the client doesn’t pay there is no duty on the freelancers to pay us anything back. The client pays on the payment schedule that was set. If it’s 60 day payment terms on the invoice then the worker takes advantage of that.

How is it different from a payday loan other than you just saying that it is?

The main difference is there is no payback, no future liability. If there’s a loan typically it comes with a term or an interest rate based on time which is not the case here, and you would have to pay it back. If you didn’t there would be penalties. This is what we would call in the industry factoring. There are 700 providers in the U.S. alone that do factoring with a volume that is over $100 billion I think although don’t quote me on that number. It’s a large industry worldwide factoring.

There are a number of big companies have instituted similar withdrawal options, Walmart, Uber.. Is this different than that?

I think over all from a financial wellness perspective and as technology evolves, early payment will become more and more prevalent for employees as well as freelancers. I think the names you mention is a mix of freelancers and employees. In our industry it’s a very important feature for a freelancers to be able to get access to their funds. But I would reiterate they can consider that a cost of doing business. Some of the examples you mentioned the freelancers doesn’t set their rate.

Is Fastfund predatory? Because it feels predatory to me.

I would put it this way: it’s a voluntary feature. If you strip the feature away the worker still gets paid after 60 days. That is still the option they have. I would not categorize workers on the WorkMarket platform as unskilled workers. Mostly skilled. I can’t read their minds but I think in many cases again this is more about managing cash flow and not having to worry about a multitude of payment cycles and making sure you actually get paid rather than being really strapped for cash. The average value of an assignment on our platform is in the hundreds of dollars.

I know you cant say so but, come on, isn’t it kind of weird?

The first part of your statement is correct! What I’ll say there is we always look for market feedback on any of our services so that’s definitely the case here. We’ll continue to monitor what we hear from freelancers, what we hear from our clients, and based on that continue to adapt our service offerings. With FastFunds we haven’t necessarily had that much negative feedback.

Maybe because there aren’t as many pain in the ass journalist using it yet?

That may change! Other media outlets have made public statements about using the service.

Well, ok I just want to say that dangling a little cash in front of freelancers who might be starving is a bad look and I’d really encourage you to reconsider it.

Duly noted and appreciate the feedback.